Irs Fsa Rules For Terminated Employees 2025 Images References :

Irs Fsa Rules For Terminated Employees 2025 Images References : - Irs Dependent Rules 2025 Henka Lethia, Households with fsas put an average of $2,250 into their accounts annually,. Fsa Rules 2025 Sada Wilona, Claims incurred during a grace.

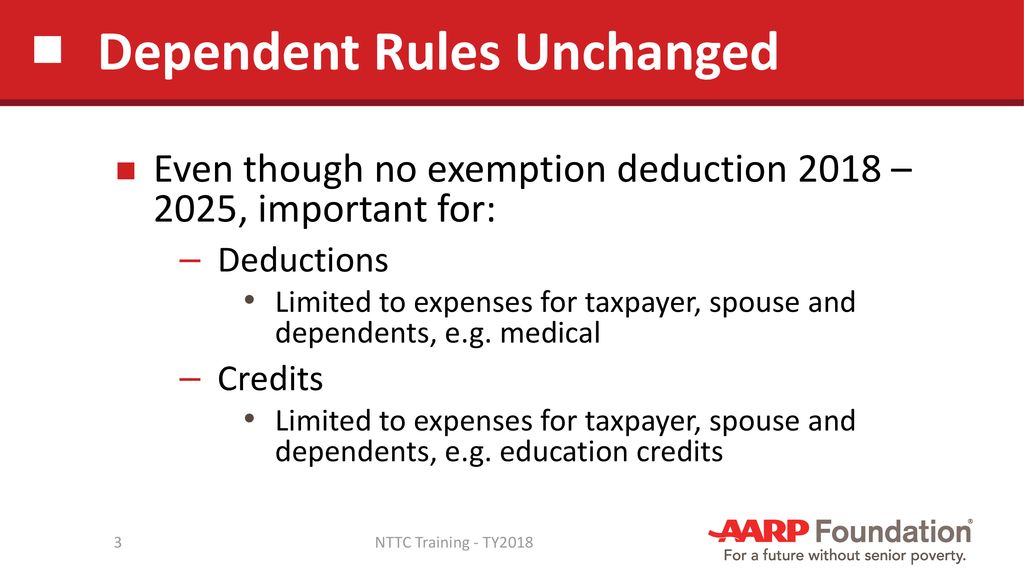

Irs Dependent Rules 2025 Henka Lethia, Households with fsas put an average of $2,250 into their accounts annually,.

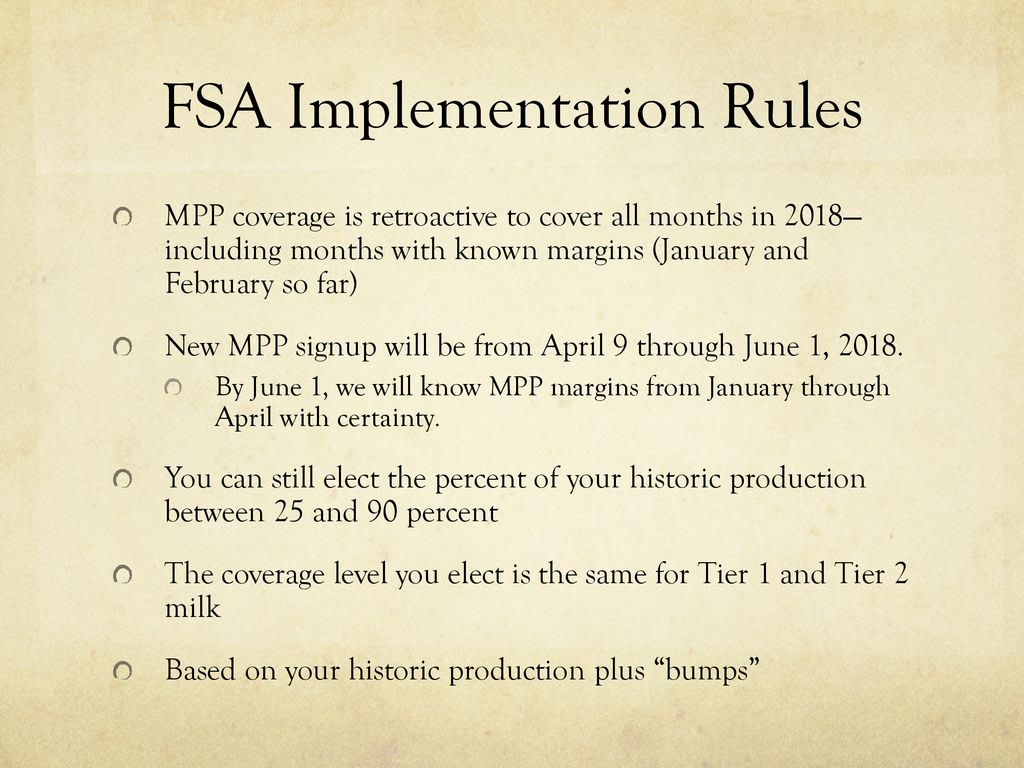

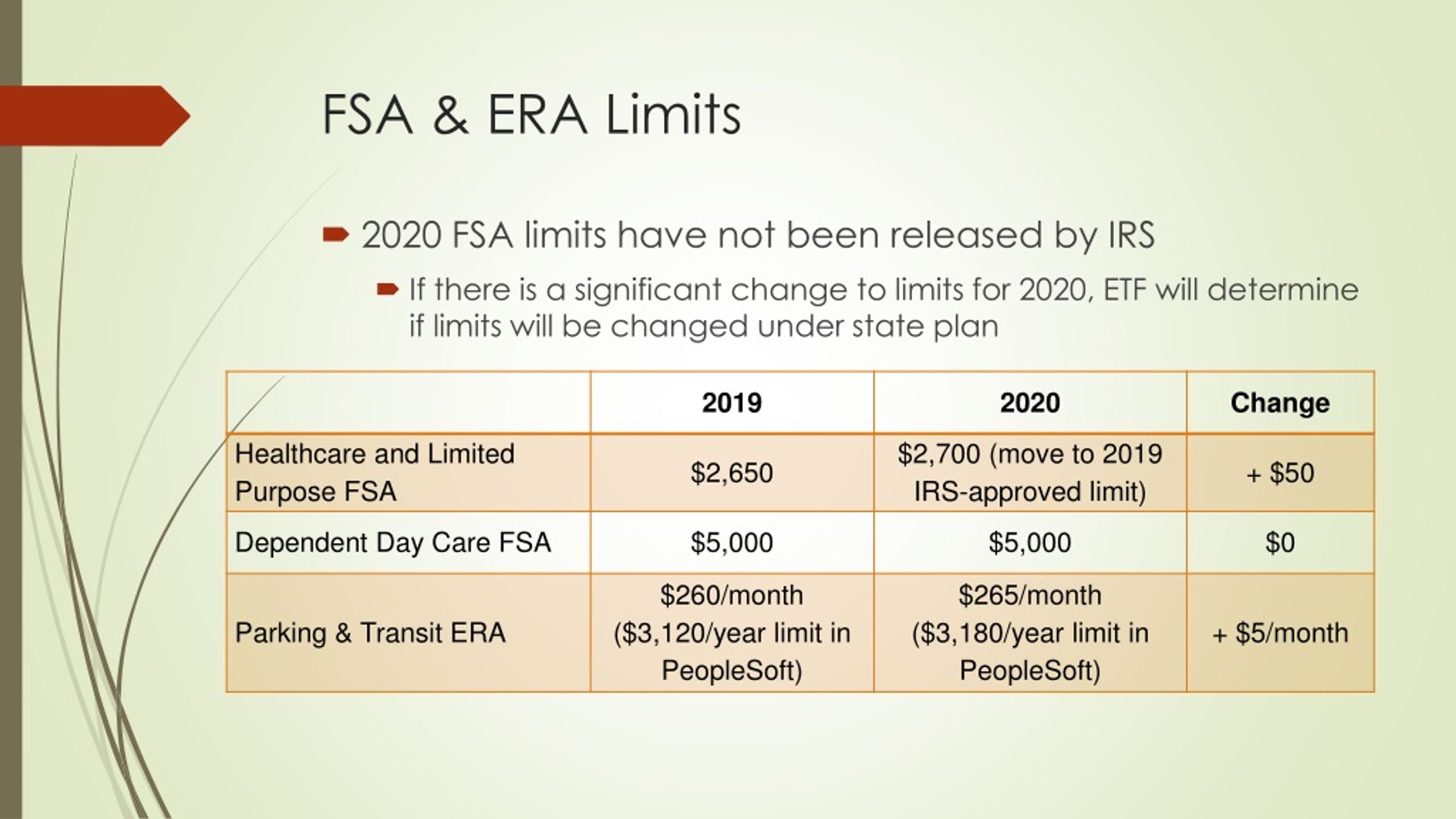

Fsa Rules 2025 Sada Wilona, In 2025, participating employees could put up to $3,200 in a health care fsa account.

Fsa Rules 2025 Sada Wilona, That means fsa participants typically need to spend most or all of.

Fsa Rules 2025 Sada Wilona, If your spouse has a plan through their employer, they may also contribute up to $3,300 through payroll.

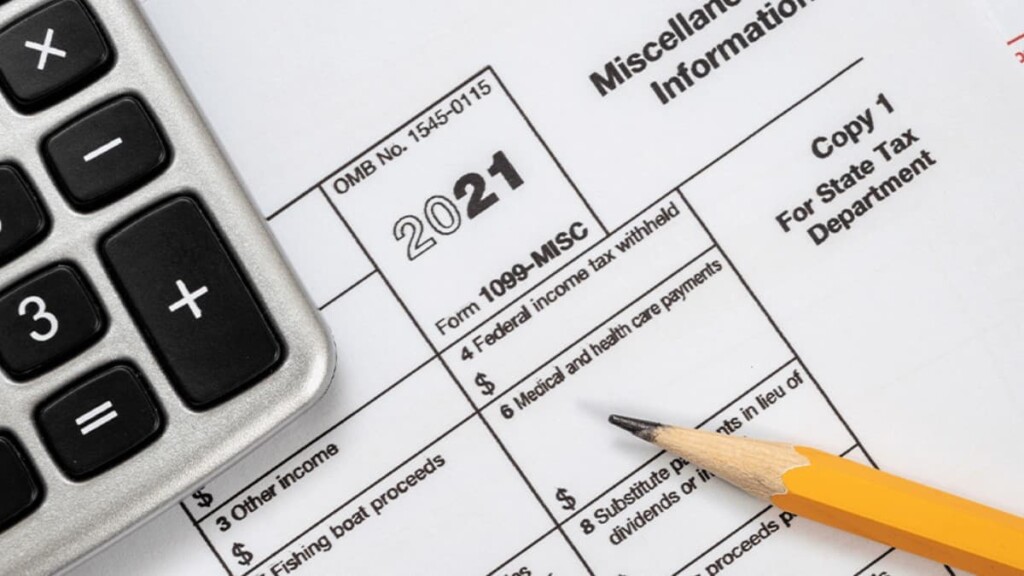

If the plan allows, the employer may. A sign outside the internal revenue service building is seen in washington on may 4, 2025.

Irs Fsa Rules For Terminated Employees 2025. An employee who chooses to participate in an fsa can contribute up to $3,300 through payroll deductions during the 2025 plan year. See requirements & rules to ensure compliance with the irs guidelines for fsas.

Irs Fsa Rules For Terminated Employees 2025. An employee who chooses to participate in an fsa can contribute up to $3,300 through payroll deductions during the 2025 plan year. See requirements & rules to ensure compliance with the irs guidelines for fsas. If the plan allows, the employer may. A sign outside the internal revenue…

Fsa Rules 2025 Sada Wilona, Maximize savings with updated irs guidelines.

Irs Dependent Rules 2025 Henka Lethia, On october 22, 2025, the irs released rev.

:max_bytes(150000):strip_icc()/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif)

Irs Fsa Rules For Terminated Employees 2025 Emma Bell, Fsa contribution limits 2023 2025 fsa maximum contribution.

Irs Dependent Rules 2025 Henka Lethia, For the 2025 tax year, the irs sets limits on how much an employee can contribute to their fsa:

Irs Fsa Rules For Terminated Employees 2025 Fiann Jeralee, See requirements & rules to ensure compliance with the irs guidelines for fsas.